The Changing Face of Retail in South Africa

While we know and accept that retail is changing, but it’s often hard to know how—and for retailers, particularly what this means and how they should respond. The latest State of the Retail Nation report by NIQ South Africa provides some useful information that may help retailers to make strategic decisions about where and how to invest in their own future.

The main message from the report was positive. Sales in the FMCG in South Africa sector are worth around 452 billion rand per year (about 24 billion USD), and the sector appears to be growing at about 8.8% per year. However, this growth masks some important and ongoing changes in consumer behaviour that are worth unpicking.

Evolving consumer habits are driving change

The report identified that changing consumer habits are driving considerable change in the retail sector, especially in FMCG. One important change is that people are going less often to grocery stores, but buying more each time. Five years ago, most people made around six visits to grocery stores each month. Now, however, this has dropped to around four visits. The report’s authors suggest that this is because of the increased cost of living in South Africa. Overall, almost half of consumers feel under some financial pressure, and have changed their habits to save money. Fewer trips mean less fuel—and this is therefore more cost-efficient.

Financial pressure has also led to consumers showing more loyalty to particular retailers, to maximise their ‘loyalty points’. They are also tending to shop closer to home as well as going shopping less often to save on fuel. Finally, they are more likely to buy ‘own brand’ products rather than branded options, again to save money. More than a third also say that they buy brands that are on promotion, rather than being loyal to particular brands. However, retailers and manufacturers alike are pushing back against this: NIQ predicts that the number of promotions will fall in the next two years as manufacturers try to protect their margins.

A disrupted sector

The report also highlights some interesting trends in the technology and durables sector. Absolute sales are relatively flat. However, within that, there is considerable dynamism: some large areas of growth, and some big changes. There is an ongoing and clear trend of sales moving online, with significantly faster growth there than in ‘bricks and mortar’ stores.

There are also some particularly strong areas of growth, including coffee machines. The report’s authors joke that consumers may have decided that the only way to face rising costs of living, energy crises and an election is with more coffee. Alternatively, and perhaps more realistically, these purchases may be a way to cut spending in expensive coffee shops, and therefore reduce costs over the longer term.

The other area of growth was emerging brands. This suggests that customers are increasingly looking for better value for money, and starting to question whether the established brands are worth the price. In the smartphone market, for example, Chinese brands grew by a massive 93.6%. This growth was across all areas: budget, mid-market and premium goods. The growth in smartphone buying has been prompted by the South African government’s decision to discontinue 3G bandwidth. However, the reasons cited for choosing emerging brands included a wider product choice, especially in the 5G market, the inclusion of extra accessories, and access to better features and technology at a lower price.

Overall, the message is that customers are willing to spend, but are becoming more cautious with their money. They want more or better value, not just higher prices.

Responding to change

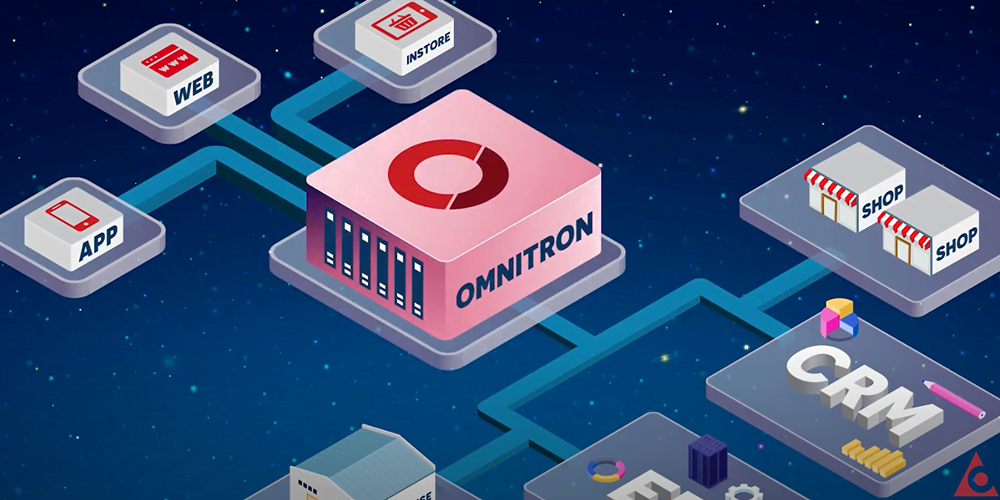

How should retailers respond to these changes? I believe the key lies in the strong growth of online sales. The importance of technology in adapting to changing consumer preferences cannot be underestimated. This is particularly true in the context of emerging brands providing better value for customers. Retailers need to be able to provide seamless experiences to customers across all channels. To do so, they will need to adopt agile, scalable, and composable technologies. This will help to future-proof operations, giving them options to expand and adapt to meet new consumer trends.

There are also lessons for tech providers like Akinon. We need to align with these consumer trends to drive innovation and offer competitive solutions in the market. That will enable us to keep up with our customers’ demands—and in turn help them to keep up with their customers.