Why Apparel and Fashion Retailers Need to Consider Their Entire Supply Chain When Evaluating Commerce Platforms

The apparel and fashion industry is facing tricky times. The global cost-of-living crisis means that non-essential purchases are being carefully considered. McKinsey’s State of Fashion 2024 report found that performance in Europe and the US struggled throughout 2023, and even China, where there was a strong start, faded later. The luxury goods segment also started strongly, but again faded – perhaps explaining why leaders in the industry were generally unclear about the future. Fundamentally, supply chain pressures are driving down profits, and consumers are buying less.

In this challenging climate, how can fashion and apparel brands stay ahead?

A large but challenging market

The global apparel industry is expected to be worth nearly $2 trillion by 2028. This is a massive market that encompasses the design, production, distribution, and retail sale of clothing, footwear and accessories. The largest segment is women’s apparel, worth more than half of the overall value of the industry, with the two other main segments being men’s and children’s apparel. Unpicking the experience of the last few years suggests that there are several trends driving the market, including:

- The rise of online shopping. The share of e-commerce in the apparel industry has risen steadily over the last few years, according to data from Statista, and now represents around a third of sales. The share of mobile is also rising, and is now approaching 75% of e-commerce sales, with just a quarter of those from desktop.

- Increased interest in sustainability. The share of sustainable apparel has also risen rapidly in recent years. Eco-conscious consumers are driving demand for more sustainable practices in the industry including ethical production, transparent supply chains, and more use of recycled materials.

- Rapid growth of the second-hand market. Second-hand buying is not new—but the growth in that market for apparel is almost unprecedented. The resale (or recommerce) market for clothes is exploding, as customers seek sustainability, affordability and unique pieces.

- Prioritisation of value over fast fashion. Consumers are becoming more careful about their purchases, valuing quality and longevity over ephemeral trends. This shift favours brands that are less driven by fashion, but is also linked to the move towards sustainability.

- The use of technology to improve customer experience. Technology such as augmented reality is transforming how we shop. It allows customers to try on outfits virtually, improving satisfaction and reducing returns. Personalisation is also extending to product customisation.

Generally, these trends show consumers who value convenience, but also recognise the impact of their actions and choices – and are keen to keep that impact as light as possible. Brands have to work hard to keep abreast of these consumers, and differentiate themselves from their competitors.

Creating a unified approach

Some apparel retailers might treat in-store and online as very different things. However, consumers don’t see it that way. The tendency is often to browse for goods online, and then visit a shop to try on products in person. This avoids spending time and energy returning clothes that don’t fit or aren’t what was wanted. The problem comes when online systems don’t allow for accurate in-store stock checks, leading to frustration and disappointment.

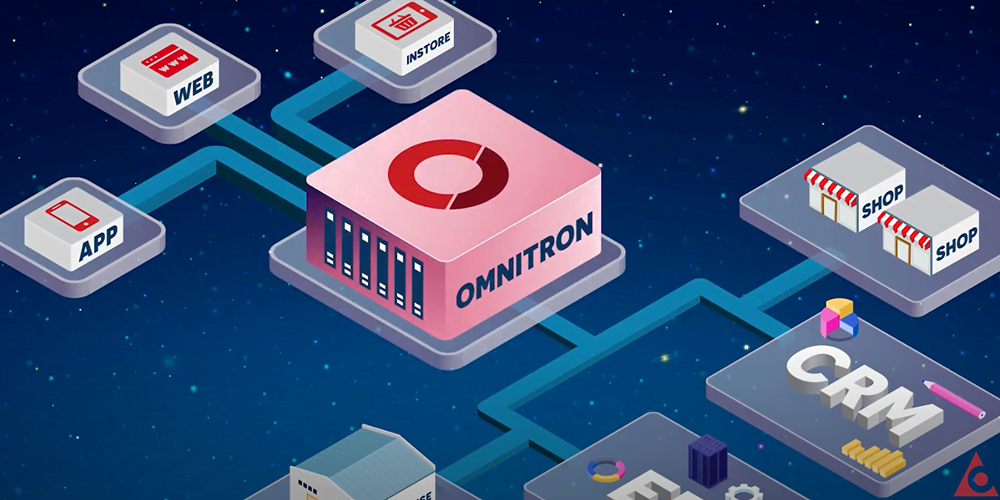

To address this, retailers are increasingly turning to unified commerce platforms. These bring together online and offline channels, and combine them with accurate real-time inventory information. Both customers and in-store staff can see stock levels and locations, eliminating frustration. These platforms also integrate customer information. Customers can be provided with tailored recommendations and offers based on their previous shopping history. Loyalty schemes can be used to build points for customers and a picture of customer behaviour for retailers, further enabling personalised marketing. Sales and discounts can also be offered consistently across all channels, ensuring a fair experience for everyone.

Unified commerce channels don’t just improve the customer experience. They also enable better operational efficiency through streamlined inventory management. Easier order fulfilment leads to faster delivery or pick-up for customers, and cost savings for the company. Insights into customer behaviour enable tailored and personalised marketing for all customers, meaning that offers are more likely to be acceptable.

Staff in store can also access customer data and order history, enabling them to provide better product recommendations and support. This improved customer service leads to happier customers, greater loyalty, and more sales. Fashion retailer Koton chose Akinon’s unified commerce platform because it supported a better omnichannel experience. The company highlights the importance of click and collect and the ability to buy online and return in-store as crucial for its customers. Since the adoption of the unified commerce platform, Koton has seen conversion rates increase by 90%, and orders by 43%. It has also improved checkout and order completion times by more than 50%.

Last week, I had the opportunity to attend Shoptalk Europe in Barcelona, where I spoke with our customers, industry analysts, and thought leaders. A common priority that emerged from these conversations was the importance of unified commerce. I strongly encourage apparel brands to explore this concept, ensuring both a single view of the customer and a single view of inventory on a unified commerce platform.

Creating a bright future for apparel retail

There is no doubt that unified commerce platforms have huge potential. However, implementation requires careful planning. Integrating systems is complex, and may require technical expertise. Migrating customer data brings significant security challenges, and needs care. Across the whole company, moving to a unified system may need a change in culture and approach, and certainly needs buy-in from staff across sales, marketing and operations.

Apparel brands will have to decide for themselves whether the benefits of unified commerce outweigh these challenges. Those who have taken the plunge already—and invested the necessary time in implementation—are positive. These brands will be well-placed to respond rapidly to evolving consumer expectations and demands over the next few years. Crucially, they are already able to create seamless and personalised omnichannel experiences—and that is what consumers want. Unified commerce therefore offers a good way to keep pace with customers in a competitive and fast-moving market.