Sustainability and Economic Efficiency: The #Recommerce Way

Recommerce is the sale of previously owned products via retail channels. It has seen a notable increase in popularity in recent years. Selling second-hand goods is obviously not new, but recommerce has now evolved into a significant segment within the e-commerce ecosystem.

Tapping Into Consumer Support for the Environment

This reflects both a change in consumer attitudes and current economic and environmental trends. Recent studies have forecast that by 2024, the resale of used products will represent nearly 15% of the market share in apparel, footwear, and accessories. This is a substantial increase from less than 7% in 2020. The apparel resale sector alone is expected to reach a valuation of $64 billion by 2024. Cross-Border Commerce Europe valued the EU’s recommerce market at €75 billion in 2021. This is projected to grow to €120 billion by 2025, a growth rate 20 times faster than the broader retail market. Overall, 93% of consumers state that inflation influences their decisions to buy and sell pre-owned items. This concern seems likely to be driving much of the growth in the recommerce sector.

Most of us are probably familiar with platforms like Etsy and eBay. However, the phenomenon of recommerce extends well beyond these. Brands are recognizing the economic benefits of re-capitalizing on goods from which they have already profited. This shift marks a critical point in the relationship between sustainability and e-commerce. For me, it suggests the need for a deeper exploration of recommerce’s history, economic and environmental implications, and increasing significance, with an eye to the future.

Tracing the Roots of Recommerce

Recommerce is deeply rooted in history. Bartering systems, thrift and charity stores, pawnshops, and consignment stores were all early manifestations of the same phenomenon. These establishments were often pivotal in local economies because they provided access to affordable goods. They also encouraged item reuse. The digital age and advancements in logistics have only amplified the practice, extending sellers’ reach to a much wider audience. Platforms like eBay and Craigslist highlight both the potential and the rapid expansion in this practice. It seems likely that recommerce is benefiting from the benefits it offers in both affordability and sustainability, giving it a double boost during a cost-of-living crisis.

At the top end of the scale, eBay is recognized as a leader in sustainable marketplaces in Europe and is a major force in the recommerce world. It provides a platform for selling and buying used, refurbished, and repurposed items. Originally designed as a peer-to-peer platform, it has now been colonised by businesses keen to take advantage of the markets that have opened up. At the other end of the scale, more local platforms like sahibinden.com in Turkey highlight the diversity within recommerce. This platform offers a range of used goods sold directly by their previous owners.

Circular Economy’s Early Adopters

However, perhaps the real expansion in recommerce has been driven by retailer-owned specialist sites like Patagonia’s “Worn Wear” and Ikea’s “Buy back and resell” program. These broaden access to used goods across various categories. An example of a similar approach in the Middle East is Dolap.com. This is a fashion vertical marketplace that allows customers to exchange apparel.

Patagonia has long championed sustainability, including using recycled material in its new clothing. It should therefore not be a surprise that it was one of the first retailers to set up its own second-hand marketplace. The company notes that 85% of clothing bought, including many of the returns made in ‘fast fashion’ and e-commerce, ends up in landfills or is incinerated. Patagonia’s WornWear website is clear that one of the best things that any of us can do for the planet is to “use stuff for longer” and reduce our overall consumption. It goes on to point out that this means “buying less, repairing more and trading in gear when you no longer need it”.

The revival of recommerce is therefore fueled by both economic and environmental motivations. Economically, it appeals to budget-conscious shoppers, offering value for money during uncertain financial times. Sites run by retailers also offer a guarantee of quality that is very appealing. Environmentally, recommerce represents a step towards more sustainable consumption, extending product lifecycles and reducing waste. This is particularly important amid increasing concerns about overconsumption and its environmental impact.

Is Recommerce the Future of E-Commerce?

Recommerce’s integration into e-commerce is not just a trend. It is also a crucial evolution towards more sustainable consumption. It benefits both consumers and the environment by offering affordable products and promoting environmental conservation. It also provides benefits for retailers. First, it offers a second chance to profit from goods already sold. Second, it enhances brand loyalty, attracting consumers who prioritize sustainability, and third, it is likely to attract investors who value companies with stronger ‘green credentials’.

I believe that we are approaching a tipping point in recommerce. Now is the time for retailers to get involved. There is still some ‘first mover’ advantage available. However, the cost of moving into recommerce will probably not be substantial, because many of the systems and practices required to support recommerce are already built into e-commerce platforms.

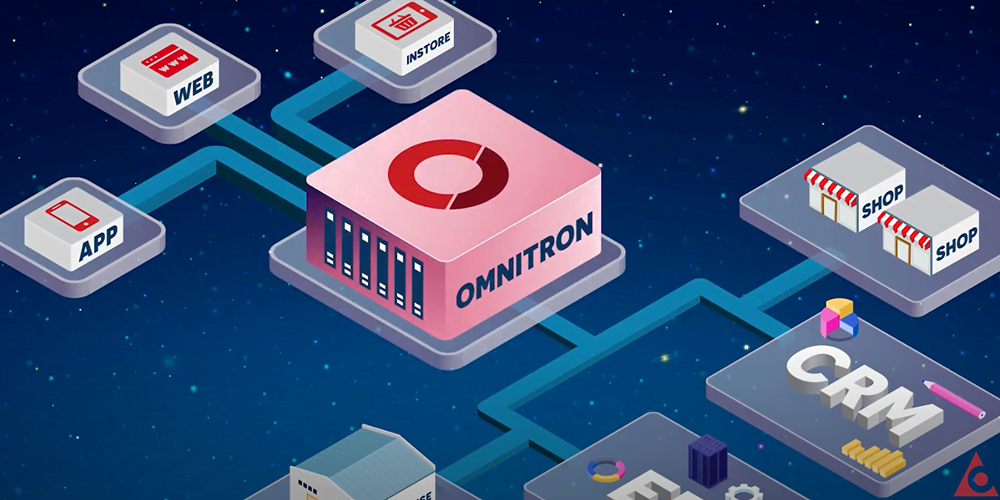

For example, buyback programs to supply recommerce marketplaces can use and repurpose systems for returns and store credits. Some platforms also have trade-in extensions that can easily be applied. Many also have systems for quality control and grading, and these can support dynamic pricing of second-hand goods based on their quality and/or age. Ideally, systems will apply to both online and in-store sales and returns – and the best platforms also offer the facility to buy online and return in store, coupled with online customer support.

A Winning Situation

By integrating online and offline channels, data becomes centralized, enabling managers to gain holistic insights into customer behavior and market trends. This comprehensive view empowers transformation managers to strategize and execute transformative initiatives more efficiently. The goal is to implement cohesive strategies across all touchpoints, ensuring consistent customer experiences and optimizing operational efficiency. Real-time analytics and adaptable systems facilitate agile decision-making, allowing managers to quickly respond to changing market dynamics and drive continual improvement in the organization’s transformation efforts.