The Saudi Growth Momentum is Good News for E-commerce

Saudi Arabia is undergoing an ambitious economic transformation, driven by the government’s Vision 2030. This national plan was launched in 2016 to guide the country’s economy away from its heavy reliance on oil revenue, and towards other sectors such as tourism. Vision 2030 set out some key targets, such as reducing unemployment, especially among young people, and increasing women’s participation in the workforce.

The plan also encouraged greater private sector participation, particularly aiming to increase the number of small and medium-sized businesses in the country. These make up a relatively small part of the economy in Saudi Arabia, especially compared to many other countries.

Having an impact

Eight years on, there are strong signs that Vision 2030 has already had an impact. Unemployment is down. The private sector as a percentage of GDP is up from 2017, albeit significantly less than it will need to be to meet the 2030 target. Women’s participation in the workforce is very definitely up, and already higher than the target for 2030. Non-oil government revenue is also significantly increased. There has been a big increase in the number of small businesses: the number has doubled since the launch of the Vision document. More importantly, perhaps, 45% of these businesses are owned by women.

What is almost more interesting than the broad macro-economic progress is the social impact of Vision 2030. The hospitality and leisure sectors are expanding rapidly, changing social norms for young Saudis—which is the majority of the population given that the median age is just over 30 years old. The population is also increasingly focused in Riyadh, the capital. Saudi Arabia’s rate of urbanisation is much faster than many other countries, and over 80% of the population lives in cities.

Vision 2030 also promotes digital transformation and the government has been investing heavily in digital infrastructure. This has encouraged the growth of Saudi Arabia’s e-commerce sector, albeit from a relatively low base.

Expanding e-commerce: a positive picture

The expansion of e-commerce in Saudi Arabia is made more likely by two factors. The first is the country’s high smartphone penetration rate of 97%. The second is the fast internet speeds available there, which is crucial for rapid adoption of e-commerce. These two factors enable easy access to online shopping platforms, and are starting to fuel growth in the sector. The young—and therefore tech-savvy—population also makes growth more likely.

Figures from the Ministry of Commerce suggest that this promise is already starting to be delivered, with the number of e-commerce records up over 17% year-on-year in the second quarter of 2024. Estimates suggest that annual growth of e-commerce in Saudi Arabia is around 13.5%, compared with just over 11% globally.

The number of people using the internet for e-commerce is expected to grow considerably this year, to over 33 million. This is a significant increase. However, it is also fair to say that there is considerable room for growth. In 2020, online sales in Saudi Arabia accounted for just 6% of total retail sales, compared with 18% globally. That said, the COVID-19 pandemic accelerated digital adoption everywhere, not only in Saudi Arabia, so this figure has likely moved on considerably.

However, this low base is good news for e-commerce, because it suggests that there is considerable potential for future growth in this market, and that it is by no means saturated. There is a major gap compared to many leading markets. The growth is also being fuelled by better logistics and payment systems, increasing consumers’ readiness to buy online knowing that payment is safe and delivery will be reliable. The net result is that both domestic and international investors are now far more willing to invest in e-commerce start-ups in Saudi Arabia than before. Their involvement is helping to fuel growth. It is also supporting increased innovation and competition, creating a healthy marketplace.

Looking into the future

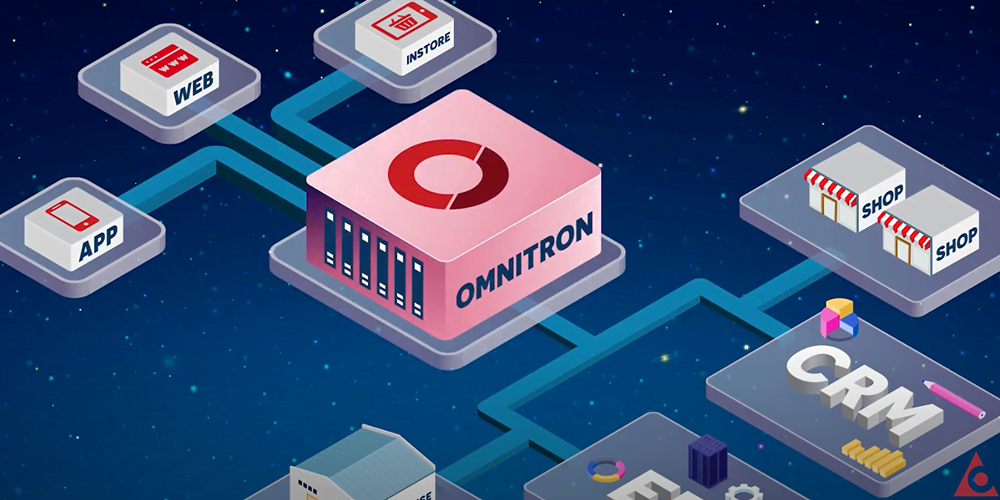

Commentators predict—and we agree—that we are likely to see considerable growth in Saudi Arabia’s e-commerce sector over the next few years. The broader retail market is growing steadily there and consumers are showing that they value the convenience of online shopping. Retailers now need to ensure that they can provide a good customer experience, provide different methods of delivery and payments as well as easy returns. They need to have a next-generation digital commerce platform with unified commerce capabilities and a composable & headless architecture. This will allow them to move ahead of the competition, and take advantage of a growing market.